The commodities market in Mexico plays a crucial role in the country’s economy, not only because of its impact on local industry but also because of its influence on international trade. For investors and financial analysts, a fundamental tool in evaluating price trends is the moving average.

In this article, we will explore what this tool is, how it applies specifically to the Mexican commodities market, and the benefits it offers to traders in this sector.

What is the moving average?

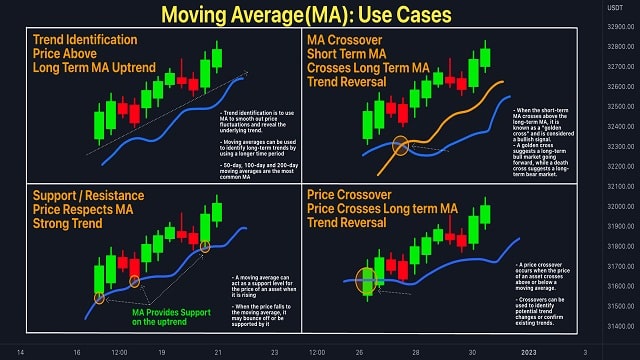

The moving average is a statistical indicator that smooths out fluctuations in commodity prices over time, providing a clearer view of the overall trend.

It is calculated by averaging the prices of an asset over a specific period of time. There are several types of moving averages, including the simple moving average (SMA) and the exponential moving average (EMA), each with its own advantages and applications.

- SMA: Calculated by adding the closing prices of an asset over a given period and dividing the total by the number of periods. For example, a 20-day SMA is calculated by adding the closing amounts for the last 20 trading days and dividing the result by 20.

- EMA: Gives more weight to recent prices, making it more sensitive to changes in the market. This is achieved by applying an exponential weighting factor that gives greater importance to more recent values.

Application in the Mexican market

Anyone interested in learning how to invest in commodities in Mexico should know that it includes various elements such as oil, natural gas, metals (such as gold and silver), and agricultural products (such as corn and coffee). The application of the moving average in it allows investors and analysts to identify trends, determine entry and exit points, and manage risks more effectively.

One of the main applications of this tool is the identification of price trends. For example, if the price of oil in Mexico is above its 50-day moving average, this may indicate an uptrend. On the other hand, if it falls below the moving average, it may signal a downtrend. This is especially useful in volatile markets where daily fluctuations can be misleading.

Traders can also use them to set entry and exit points in the market. A golden cross, which occurs when a short-term moving average crosses above a long-term moving average, can be a buy signal. Conversely, a death cross, where the short-term moving average crosses below the long-term moving average, can be a sell signal.

This tool also helps in risk management. By monitoring the distance between the current price and the moving average, investors can set stop-loss levels to limit their losses.

For example, if the price of corn is significantly above its 200-day moving average, an investor may decide to set a stop-loss just below this value to protect his profits.

Some illustrative examples

To illustrate the practical application of moving averages in the Mexican commodity market, let us consider two examples: oil and corn.

1. Oil

Oil is one of the most important commodities for the Mexican economy. Suppose an analyst uses a 50-day moving average and a 200-day moving average to study oil price trends. If the price of oil crosses above the 50-day SMA, this could be interpreted as the beginning of an uptrend. If it subsequently crosses above the 200-day average, this would reinforce the signal of a more sustained positive trend.

2. Corn

Corn is another key commodity in Mexico, both for domestic consumption and for export. A farmer or trader could use a 30-day EMA to more sensitively track changes in the price of corn. If the value falls below the 30-day average, the trader could consider selling part of his inventory to avoid further losses.

It can be said then that the moving average is an invaluable tool for investors and analysts in the Mexican commodities market. Identifying trends, determining entry and exit points and managing risks makes it essential in any investment strategy. However, it is crucial to complement it with other indicators and sector analysis to make informed decisions and minimize risks. In such a dynamic landscape, the SMA and EMA offer a clear and accessible guide to navigating the complexities of trading and investing.